Buying a home is one of the biggest financial decisions many of us will ever make. In Sydney’s fast-moving property market, it’s easy to feel pressure to move quickly or skip a pre-purchase inspection. While this may save a few hundred dollars up front, it also means you may be unaware of issues that could become costly in the future.

The truth is simple: homes often hide problems that aren’t visible during a walk-through. From structural cracks and water damage to electrical faults and termite infestations, these issues rarely reveal themselves until it’s too late. A pre-purchase inspection is your safeguard against buying into a money pit.

At ImpeccaBuild, we’ve seen the consequences firsthand. Many inspection companies rely on subcontractors or franchise operators without a building background. They might tick boxes, but they can easily miss the hidden defects that licensed builders are trained to identify. Our team brings decades of hands-on construction experience, giving buyers a clear picture of a property’s true condition.

In this article, we’ll uncover six hidden risks of buying without a pre-purchase inspection. By the end, you’ll understand why skipping this step isn’t worth the gamble—and how working with a licensed builder-backed team like ours protects both your investment and your peace of mind.

Understand the Hidden Risks of Buying without A Pre-Purchase Inspection Before You Commit.

Uncovering the True Risks of Skipping Inspections

When buyers in Sydney skip a pre-purchase inspection, it’s usually for two reasons: they want to save money or they don’t want to slow down the purchase process. On the surface, this might seem reasonable. After all, when you’re already stretched with stamp duty, mortgage approvals, and moving costs, an inspection fee of $500–$800 can feel like another burden. But the reality is very different: that small saving often leads to far greater losses in the long run.

One of the biggest risks is uncertainty. Without an inspection, buyers may lack clear insight into a property’s condition. Superficial upgrades – like fresh paint or new carpet – might hide underlying issues such as cracks, damp or electrical concerns. Because sellers aren’t required to disclose every potential problem under NSW Fair Trading rules, inspections offer a valuable opportunity to identify visible warning signs before settlement.

Another overlooked risk is negotiation power. A detailed inspection report gives buyers leverage to request repairs or adjust the purchase price to reflect hidden costs. Consumer advocates such as Choice highlight that inspection reports are one of the strongest tools for buyers to negotiate fairly. Without this safeguard, you’re essentially agreeing to pay full price for a property that could require tens of thousands in immediate or future repairs.

This is where the choice of inspector becomes critical. Many companies in Sydney send out franchise operators or subcontractors who may not hold a building licence. They might run through a checklist, but they don’t have the trained eye to spot the underlying problems that can cripple a home. At ImpeccaBuild, we approach inspections as licensed builders with decades of practical construction experience. We know how homes are put together, and more importantly, we know where they fail. That expertise ensures our clients aren’t blindsided by the hidden risks that others overlook.

Skipping a pre-purchase inspection is not just a financial gamble—it’s a decision that puts your safety, comfort, and investment at risk.

Structural Defects Are One of The Biggest Risks of Buying without A Pre-Purchase Inspection.

Hidden Risk #1: Structural Issues and the Risks of Buying Without a Pre-Purchase Inspection

A key risk when buying without an inspection is that structural issues may be missed. Cracks in foundations, sagging ceilings or water-affected support beams may not be obvious on a walkthrough, but could lead to costly repairs over time. A professional inspection helps identify visible signs of structural concern in accessible areas.

The National Construction Code (NCC) sets minimum safety and structural standards for residential buildings nationwide. As outlined by the Australian Building Codes Board (ABCB), these standards are non-negotiable for ensuring building integrity. When these standards are not met—due to shoddy workmanship or age—it can result in repairs that cost tens of thousands of dollars, especially in Sydney properties where older construction is common. en.wikipedia.org+1

Many inspection providers rely on subcontractors or franchise operators without a building licence, meaning they may simply tick boxes on a checklist. They can miss subtle signs of structural failure that a licensed builder would catch. At ImpeccaBuild, our inspection team comprises licensed builders with decades of hands-on experience. We spot the tell-tale signs—like stress fractures in walls or hidden moisture affecting load-bearing beams—that less experienced inspectors often overlook. That level of insight protects our clients from walking into a structurally compromised property.

Pest Damage Is a Serious Risk of Buying without A Pre-Purchase Inspection in Sydney Homes

Hidden Risk #2: Termites and Timber Pests – A Major Risk of Buying Without a Pre-Purchase Inspection

Another serious risk of buying without a pre-purchase inspection is failing to uncover timber pest activity—especially termites. Termites are often called “silent destroyers” because they attack a home’s structure from the inside out, leaving little trace until major damage has already occurred.

In Sydney, the risk is particularly high due to the prevalence of older homes with timber framing, combined with conditions that allow pests to thrive in subfloors and damp areas. Termite damage isn’t just cosmetic. Once they have compromised load-bearing timbers, the integrity of the entire structure can be at risk. Repairs are rarely minor—costs can range from $10,000 for localised treatment and repairs to well over $50,000 if large sections of a home need to be rebuilt.

The challenge is that most buyers won’t notice termite activity during a quick walk-through at an open home. Hollow-sounding timber, faint mud tracks, sagging floors, or blistered paint may all indicate hidden infestation, but these signs are subtle and easily missed.

A well-conducted inspection by experienced professionals can help identify signs of timber pest activity before contracts are exchanged. Being aware of possible termite or pest damage gives buyers the opportunity to negotiate, reconsider or budget accordingly.

Hidden Plumbing Issues Are a Costly Risk of Buying without A Pre-Purchase Inspection.

Hidden Risk #3: Plumbing and Drainage Problems – An Overlooked Risk of Buying Without a Pre-Purchase Inspection

Plumbing and drainage are often hidden behind walls, under floors, or buried underground, making them some of the hardest issues for buyers to detect. Yet they are also among the most disruptive and expensive problems to repair, and one of the major risks of buying without a pre-purchase inspection.

Leaking pipes, poor drainage, or outdated plumbing systems can quickly escalate into larger issues. Undetected water leaks may cause mould growth, damage structural timbers, and create health risks for occupants. In Sydney, where many homes are decades old and built with galvanised steel or clay pipes, failures are particularly common. Blocked or collapsed stormwater lines can lead to flooding during heavy rain, while leaking sewer pipes may require urgent and costly excavation.

The financial impact can be significant. Minor plumbing repairs may cost a few hundred dollars, but extensive excavation or full pipe replacement can run into tens of thousands. These are expenses that most buyers do not budget for and can completely derail renovation plans or stretch household finances thin.

These issues are often not obvious during a brief walkthrough. A professional inspection can help highlight visible plumbing or drainage concerns and provide better clarity on the condition of the property before you commit.

Electrical Hazards Highlight the Safety Risks of Buying without A Pre-Purchase Inspection.

Hidden Risk #4: Electrical and Safety Hazards – A Critical Risk of Buying Without a Pre-Purchase Inspection

Electrical faults can pose serious risks, especially when buying without a pre-purchase inspection. Visible issues such as damaged fittings, unlicensed DIY work or exposed wiring may indicate potential safety concerns. A building inspection can help identify these visible electrical issues in accessible areas and recommend further assessment by a licensed electrician where appropriate.

In Sydney, many homes built several decades ago still contain outdated wiring that does not meet modern safety standards. Old fuse boxes, deteriorating insulation, and the absence of safety switches are common in older properties. In newer homes, the risks often come from unlicensed renovations or quick fixes designed to cut costs, leaving buyers with systems that may be non-compliant or unsafe.

The financial impact of electrical repairs can vary widely. Replacing an old switchboard may cost a few thousand dollars, but a full rewiring job can easily climb beyond $15,000 depending on the size of the property. More importantly, until these issues are corrected, the home remains a serious safety risk.

These problems are almost impossible for buyers to detect themselves. Light switches may work, and power outlets may appear fine, but only a thorough inspection can uncover the hidden dangers behind the walls. Skipping this step leaves buyers exposed to both financial loss and the very real danger of electrical fires.

Unapproved Works Are Another Overlooked Risk of Buying without A Pre-Purchase Inspection.

Hidden Risk #5: Hidden Renovation and Compliance Issues – A Costly Risk of Buying Without a Pre-Purchase Inspection

Not every home improvement project is carried out legally or to code. One of the most underestimated risks of buying without a pre-purchase inspection is inheriting non-compliant or unapproved renovations. While an extension, garage conversion, or deck may look appealing, if the work wasn’t approved by council or doesn’t meet Australian building standards, the responsibility to rectify it falls on the new owner.

In Sydney, where demand for space is high, it’s common to see homes with additional rooms, lofts, or external structures built without proper approvals. On the surface, these upgrades may add value, but if they were not inspected or certified, they can quickly become liabilities. Buyers may face council fines, costly rectification orders, or in extreme cases, orders to demolish and rebuild the non-compliant work.

Poor workmanship or unapproved renovations are additional risks. Renovations such as inadequate waterproofing, weak structural supports or DIY fixes may lead to water damage, structural issues or safety hazards. Fixing these problems often costs significantly more than the apparent value of the upgrade.

These issues are rarely disclosed by sellers and are difficult to detect during an open home. Without a professional inspection, buyers are essentially gambling on the quality and legality of past renovations. A thorough assessment identifies non-compliant work before contracts are signed, protecting buyers from taking on unexpected financial and legal headaches.

Overpaying Is a Financial Risk of Buying without A Pre-Purchase Inspection.

Hidden Risk #6: Losing Negotiation Power and Overpaying – A Financial Risk of Buying Without a Pre-Purchase Inspection

An inspection report that clearly explains visible defects may give buyers stronger grounds to renegotiate the purchase price or request repairs before settlement. Without such insight, buyers may face unexpected costs from issues that were not evident at first glance.

In Sydney’s fast-moving property market, buyers often feel pressured to commit quickly. But rushing into a purchase without an inspection leaves no room to challenge the asking price. For example, an inspection report identifying roof leaks, outdated wiring, or pest damage could justify a $10,000–$50,000 reduction in the purchase price. Skipping this step means buyers shoulder the cost themselves after the sale.

The impact goes beyond money. Without an inspection, buyers may also miss the opportunity to walk away from a property that is simply too risky. Once contracts are exchanged and settlement is reached, the responsibility—and the financial burden—falls entirely on the new owner.

Pre-purchase inspections are more than just a safety net; they’re a bargaining tool. Losing this advantage can mean overpaying for a property while taking on unforeseen repair bills, leaving buyers financially stretched from day one.

Compare Costs to See Why the Risks of Buying without A Pre-Purchase Inspection Aren’t Worth It.

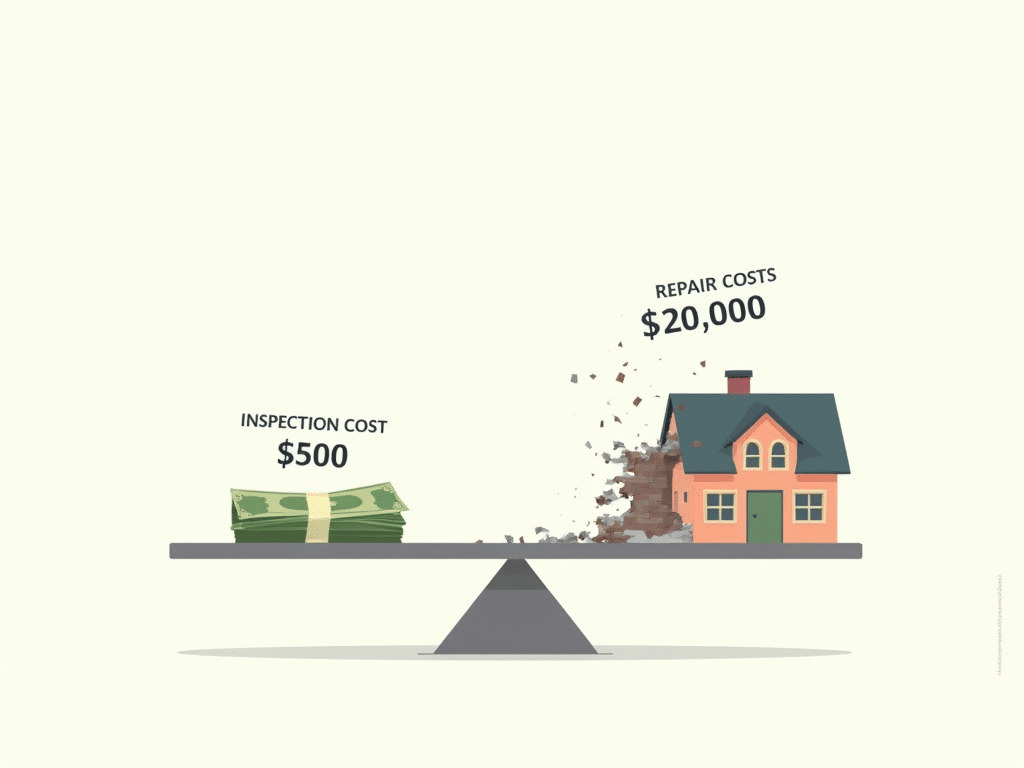

The Cost of Inspections vs. The Cost of Mistakes – Why Skipping a Pre-Purchase Inspection is a False Economy

For many buyers, the decision to skip an inspection comes down to cost. In Sydney, a standard pre-purchase inspection typically costs between $500 and $800. It may feel like an extra expense, but when compared to the possibility of significant repair costs, it can represent a prudent investment.

Consider the alternative: major structural repairs may cost tens of thousands of dollars. Even less obvious issues – like hidden leaks, outdated wiring or pest damage – can contribute significant repair budgets. These are the kinds of expenses that can disrupt renovation plans or place financial strain on new homeowners.

It’s also important to recognise that an inspection can actually save money in the long term. A comprehensive report provides negotiation leverage. Buyers can use it to secure a lower purchase price, request repairs before settlement, or walk away from a property that’s simply too risky. In this way, the inspection doesn’t just avoid costs—it can generate financial benefits that far outweigh the initial outlay.

Skipping an inspection may seem like a way to save money upfront, but it is in reality a false economy. The small cost of an inspection is an investment in security, confidence, and financial protection, ensuring buyers don’t make a decision they’ll regret.

For those weighing up inspection costs, we’ve detailed strategies to get the best value in our guide on Pre-Purchase Building Inspection Cost Sydney: 6 Ways To Save.

Impecca Build Helps You Avoid the Real Risks of Buying without A Pre-Purchase Inspection.

Why Choose ImpeccaBuild for Your Pre-Purchase Inspection

The six hidden risks we’ve covered—structural defects, timber pests, plumbing failures, electrical hazards, non-compliant renovations, and loss of negotiation power—highlight just how dangerous it can be to buy a property without proper checks. In Sydney’s high-pressure market, skipping an inspection may feel like a shortcut, but it often leads to financial setbacks and years of frustration.

This is where choosing the right inspection partner makes all the difference. Many inspection providers rely on subcontractors or franchise operators who lack a building background. They may follow a checklist, but they don’t have the depth of knowledge needed to uncover the hidden problems that can cripple a home.

At ImpeccaBuild, our inspections are carried out by licensed builders with years of practical construction experience. We know how homes are built, where defects commonly appear and how to evaluate their potential impact. This means our clients benefit from clear, practical insights before they proceed with purchase.

A pre-purchase inspection is an important step — not just a formality. By choosing ImpeccaBuild, you’re engaging a team focused on helping you better understand your prospective property so you can move ahead with greater clarity.

If you’re preparing to buy a home in Sydney, don’t leave it to chance. Book your inspection today and let us help you uncover the real story behind your property before you commit. Learn more about What Sets Our Pre-Purchase Inspections Apart.

FAQ

Frequently Asked Questions

1. What are the risks of buying without a pre-purchase inspection?

The main risks of buying without a pre-purchase inspection include hidden structural defects, timber pest or termite damage, plumbing and drainage issues, electrical hazards, unapproved renovations, and losing negotiation power on the purchase price. These problems can cost buyers tens of thousands in repairs.

2. Can I save money by skipping a pre-purchase inspection?

Skipping an inspection may save a few hundred dollars upfront, but it often leads to much higher costs later. Repairs for hidden issues like termites, faulty wiring, or foundation cracks can range from $10,000 to over $100,000. An inspection is a small investment compared to these risks.

3. How much does a pre-purchase inspection cost in Sydney?

In Sydney, a standard pre-purchase building inspection typically costs between $500 and $800, depending on the property size and level of detail required. This fee is minor compared to the potential repair costs if hidden issues go undetected.

4. Why is a licensed builder better for pre-purchase inspections?

A licensed builder has hands-on construction experience and understands how homes are built, where defects appear, and how serious they may be. Many inspection providers use subcontractors without a building background, which increases the chance of major issues being missed.

5. Do termites really cause major damage in Sydney homes?

Yes. Termites are common in Sydney due to climate and timber construction. They often remain hidden until serious damage has occurred. Repair costs can exceed $50,000, making pest detection during a pre-purchase inspection essential.

6. What happens if I buy a house with unapproved renovations?

If a property has unapproved renovations or non-compliant work, the buyer becomes responsible. This may result in council fines, costly rectification work, or even demolition orders. A pre-purchase inspection can identify potential compliance issues before settlement.

7. How does a pre-purchase inspection help with negotiations?

An inspection report gives buyers evidence of defects, which can be used to negotiate a lower price or request repairs before settlement. Without this report, buyers lose leverage and risk paying full price for a property with hidden faults.

8. Are first-home buyers more at risk if they skip inspections?

Yes. First-home buyers usually have tighter budgets and limited experience with property defects. Skipping an inspection can expose them to repair bills they cannot afford, making inspections critical for financial protection.

9. How do property investors benefit from pre-purchase inspections?

For investors, inspections protect rental income and ROI by identifying costly issues early. Properties with structural defects, pest damage, or compliance problems can dramatically reduce long-term returns.

10. Is a pre-purchase inspection worth it in Sydney’s property market?

Yes. In Sydney’s fast-moving and high-value market, skipping an inspection may increase risk. An inspection can provide clearer insight, stronger negotiation options and help you make a more informed decision.

You Might Also like:

If you enjoyed reading this blog, you may also be interested in:

- 6 Hidden Risks Of Buying Without A Pre-Purchase Inspection

- Pre-Purchase Building Inspection Cost Sydney: 6 Ways To Save

- Residential Pre-Purchase Inspections: 10 Powerful Benefits

- Local Cafe Fitout Expert Sydney: 6 Smart Reasons to Choose Local

- Choosing a Cafe Fitout Company Sydney: 5 Expert Tips for Success

- Cafe Fitout Costs Sydney 2024: Simple Tips for Maximum Savings

- Location Impact on Pharmacy Fit-Out Costs: 6 Shocking Truths

- Pharmacy Location Rules for New Pharmacies: 8 Approval Insights

- Reducing Pharmacy Fit-Out Costs: 5 Powerful Ways to Save Big

- 7 Critical Questions to Ask a Pharmacy Fit-Out Company Before Hiring