Buying a home is one of the biggest financial decisions most people will ever make, and in Sydney’s fast-paced property market, it often comes with pressure to act quickly. While a freshly painted wall or modern renovation can make a property look appealing, these surface details can sometimes hide serious issues beneath.

This is where Residential Pre-Purchase Inspections play a critical role. A professional inspection gives buyers a clearer, independent view of the property’s condition before signing the contract. It helps identify defects and risks that may not be obvious during an open home and provides the knowledge needed to make a more informed decision.

At ImpeccaBuild, we bring the unique perspective of licensed builders who have spent years constructing and inspecting homes across Sydney. We know what to look for, from structural weaknesses to pest infestations, because we’ve seen firsthand the problems that can cost homeowners thousands of dollars in unexpected repairs.

In this guide, we’ll explore the 10 powerful benefits of Residential Pre-Purchase Inspections, showing how they protect buyers from hidden risks, strengthen negotiating power, and provide the peace of mind needed to purchase with confidence.

Clear insights into Residential Pre-Purchase Inspections

What Are Residential Pre-Purchase Inspections?

A Residential Pre-Purchase Inspection is a professional assessment carried out before you buy a property to provide an informed view of its condition. The inspection provides an independent report that highlights visible issues and potential risks, helping buyers make an informed decision rather than relying on appearances or a seller’s assurances.

The scope of a pre-purchase inspection is broad, but clearly defined. Inspectors visually assess the building’s structure, roof and ceiling spaces, walls, floors, windows, doors, plumbing fixtures and accessible electrical components. They also look for signs of moisture damage, drainage problems, safety hazards and visible defects in finishes. Importantly, these inspections are visual and non-invasive, meaning no destructive testing is carried out. Instead, they focus on what can be safely observed without altering the property.

In many cases, buyers choose to combine a building inspection with a pest inspection. The building component helps identify structural concerns and safety issues, while the pest inspection looks for evidence of termites, borer activity and other timber-related damage. In Sydney, where termite activity is common in both older homes and newer builds, a combined inspection is often the most cost-effective way to gain a more complete picture of risk.

Sydney’s property market presents unique challenges for buyers. Older terrace houses may conceal rising damp or outdated wiring, apartment blocks can suffer from poor waterproofing or hidden leaks, and suburban homes often face termite risks due to surrounding vegetation. Each property type has distinct vulnerabilities, and a pre-purchase inspection helps bring these to light before contracts are signed.

At ImpeccaBuild, we approach inspections differently. As licensed builders with hands-on construction experience, we know what shortcuts to look for and which defects could become major financial burdens. Our role is not just to point out problems but to give buyers a realistic understanding of what they’re walking into, so they can proceed with confidence or reconsider a risky investment.

Key advantages of Residential Pre-Purchase Inspections

The 10 Powerful Benefits of Residential Pre-Purchase Inspections

1. Revealing Hidden Structural Issues

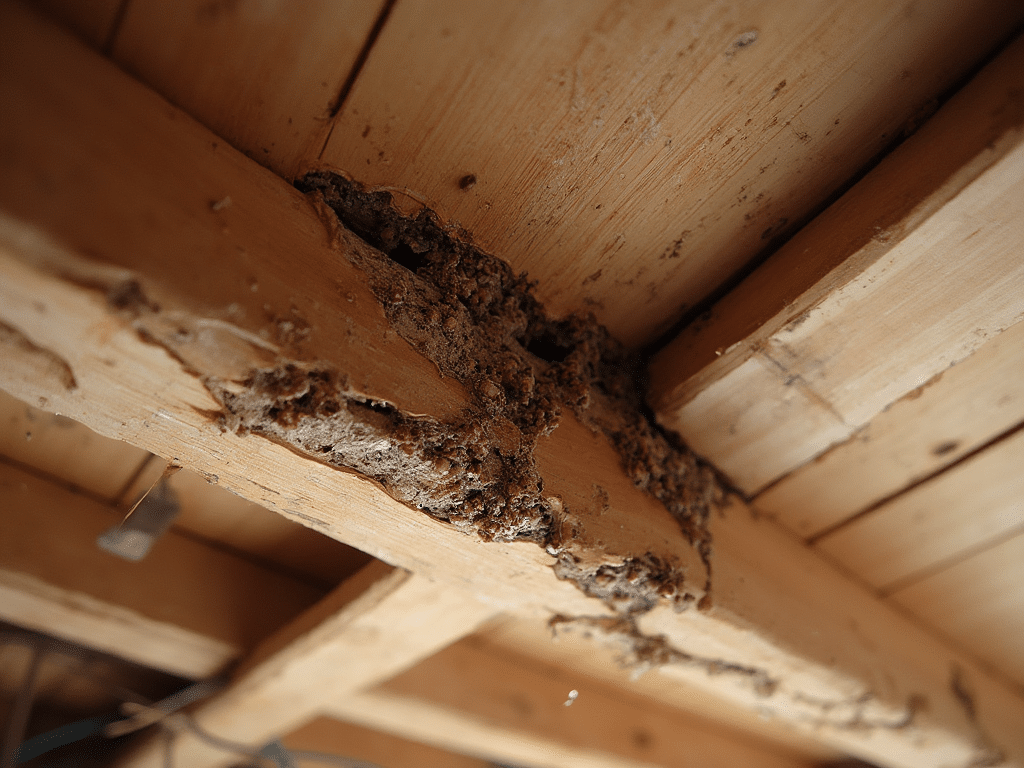

Sydney’s warm climate makes it a hotspot for termite activity, and research from the CSIRO confirms that termites are responsible for significant property damage across Australia every year. Termites often attack timber hidden within walls or subfloors where buyers cannot see, making early detection especially important.

Replacing termite-damaged flooring or framing can cost more than $30,000.

A combined building and pest inspection checks for signs of live infestations, past damage and conditions that encourage termites, such as poor drainage or timber in contact with soil. Identifying these issues as early as possible helps buyers avoid, renegotiate or better prepare for properties that may require extensive remediation.

2. Detecting Timber Pests & Termites Early

Sydney’s warm climate makes it a hotspot for termite activity, and research from the CSIRO confirms that termites are responsible for significant property damage across Australia every year. Termites often attack timber hidden within walls or subfloors where buyers cannot see, making early detection critical.

Replacing termite-damaged flooring or framing can cost more than $30,000.

A combined building and pest inspection checks for live infestations, past damage, and conditions that encourage termites, such as poor drainage or timber in contact with soil. Early detection protects buyers from inheriting a property that requires extensive and costly remediation.

3. Exposing Water Damage & Mould Risks

Water ingress is a common problem in both Sydney’s older and newer housing stock. Older homes often suffer from rising damp, while apartments are prone to balcony leaks and bathroom waterproofing failures. Left unchecked, moisture leads to mould growth, which can harm indoor air quality and cause health problems for children or those with asthma.

A professional inspection looks for tell-tale signs like bubbling paint, soft plasterboard or musty odours, helping buyers recognise properties that may require further investigation or remediation.

4. Uncovering Electrical & Plumbing Hazards

Outdated electrical wiring or poorly installed circuits can present safety risks, particularly in older Sydney homes where original wiring may still be in place. Plumbing issues such as leaking pipes, inadequate water pressure or corroded hot water systems can also result in expensive repairs.

During a Residential Pre-Purchase Inspection, inspectors note visible electrical and plumbing concerns in accessible areas and may recommend further assessment by licensed specialists. This helps buyers budget more realistically for upgrades and decide whether a property suits their risk tolerance.

5. Spotting Unsafe or Non-Compliant Building Work

Sydney’s renovation boom has seen a rise in DIY projects and unapproved extensions. While they may look appealing, many of these works may not meet building codes or may lack council approval, which can result in costly rectification orders. According to NSW Fair Trading, buyers should always confirm that building work complies with regulations before settlement.

This can create safety hazards and expose new owners to fines or costly rectification orders.

A pre-purchase inspection can highlight questionable or unusual construction, indicating where further checks with council records or other specialists may be appropriate. Understanding these potential compliance issues early helps buyers reduce the risk of legal headaches after settlement.

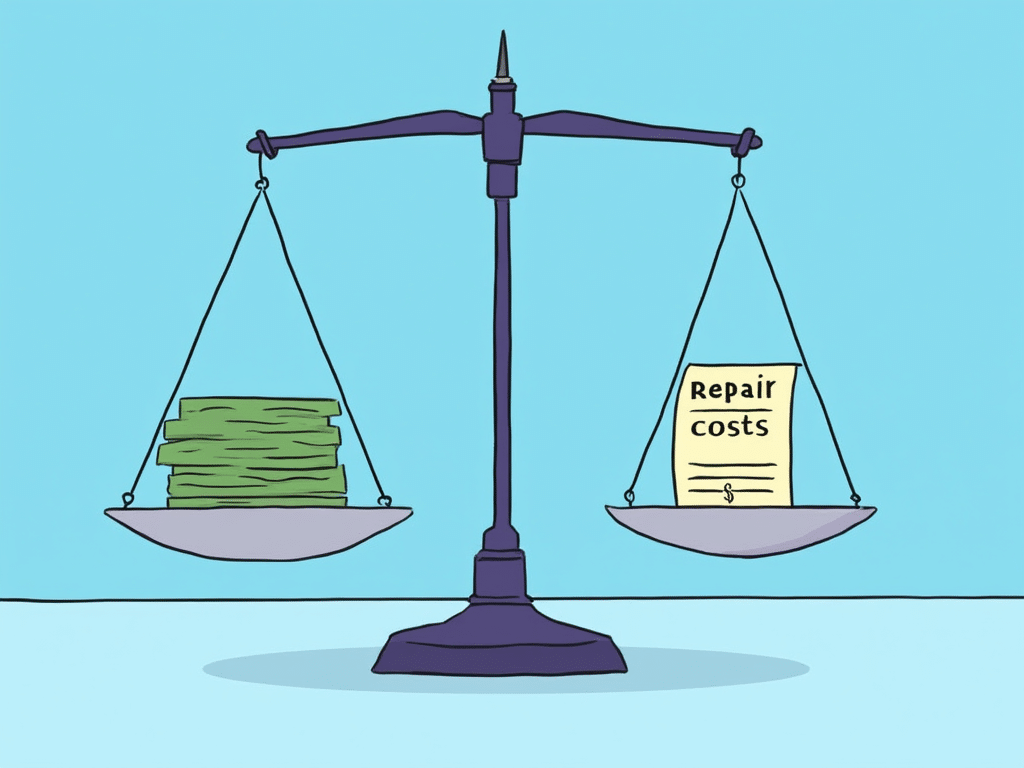

6. Identifying Costly Repairs Before Purchase

Not every defect is a deal-breaker, but buyers should know the true cost of repairs before committing. Roof replacements, foundation underpinning, or extensive waterproofing can all add up quickly. In Sydney, re-roofing a freestanding home can easily exceed $15,000, while rectifying drainage and dampness issues can be similarly costly.

When inspections uncover these repairs in advance, buyers can make informed choices — whether that means negotiating the purchase price, budgeting for future works, or choosing a more suitable property.

7. Strengthening Your Negotiating Power

An inspection report is more than a safety net — it’s a powerful negotiating tool. If defects are discovered, buyers can use the findings to request repairs, ask for a reduction in price, or insist on contract conditions. For example, a leaking roof or termite treatment requirement may justify negotiating thousands off the asking price.

In Sydney’s high-value market, even small reductions represent significant savings. Armed with independent evidence from a pre-purchase inspection, buyers have stronger leverage when negotiating with vendors.

8. Protecting First-Home Buyers from Costly Mistakes

First-home buyers are often emotionally invested in securing their dream property and may overlook warning signs. With limited budgets, unexpected repairs can quickly create financial stress. A Residential Pre-Purchase Inspection gives first-home buyers clear, unbiased information so they better understand what they are committing to.

This is especially important in Sydney, where entry-level properties are still a major investment. Knowing the risks before signing gives young buyers greater confidence and helps reduce the chance that their first home becomes a financial strain.

9. Helping Investors Maximise ROI

For property investors, every dollar counts. Unexpected repairs erode rental yield and can significantly reduce return on investment. Issues such as hidden termite damage, plumbing leaks, or non-compliant work can delay leasing and increase maintenance costs.

By arranging a pre-purchase inspection, investors gain clarity on the property’s condition, allowing them to forecast expenses accurately and ensure the investment remains profitable. In Sydney’s competitive rental market, avoiding extended vacancy or major repair bills is essential for protecting ROI.

10. Giving Buyers Peace of Mind & Confidence

Perhaps the greatest benefit of all is peace of mind. Buying property in Sydney is stressful enough without the added uncertainty of hidden defects. A Residential Pre-Purchase Inspection reduces much of the guesswork, giving buyers greater confidence that their decision is based on clear, documented observations rather than appearances alone.

Whether it’s walking away from a high-risk purchase or proceeding with assurance, inspections provide valuable clarity. For many clients at ImpeccaBuild, this confidence is the most valuable outcome of all.

Coverage explained in Residential Pre-Purchase Inspections

What Does a Residential Pre-Purchase Inspection Cover?

A Residential Pre-Purchase Inspection provides buyers with an independent overview of the property’s condition before committing to purchase. The inspection is visual and non-invasive, meaning inspectors do not open walls, remove tiles or dismantle systems. Instead, it focuses on what can be safely and practically assessed to give buyers a clearer picture of potential risks and likely repair needs.

Key Areas Assessed

- Structural elements – Inspectors look for signs in the foundations, walls, floors, ceilings and roof framing that may indicate movement, cracking or unevenness. These can sometimes be associated with issues such as subsidence or structural weakness.

- Roof and exterior – Tiles, flashing, gutters, and downpipes are reviewed for signs of leaks, corrosion, or poor maintenance. Roof issues are common in Sydney, where heavy rainfall can quickly expose weaknesses.

- Interior finishes – Walls, ceilings, floors, doors, and windows are inspected for defects such as damp stains, warping, or misaligned frames, which often reveal larger problems.

- Plumbing and drainage – Fixtures, taps, and visible pipes are checked for leaks or poor installation. External drainage, garden grading, and retaining walls are also assessed, as poor water management leads to dampness and foundation problems.

- Electrical (visible only) – Inspectors look at switchboards, power points and other visible components for obvious hazards, apparent outdated wiring or other visible concerns that may warrant further assessment by a licensed electrician.

- Moisture detection – Tools may be used to detect rising damp, bathroom leaks, or concealed water ingress. Dampness often leads to mould, a common issue in Sydney’s humid climate.

- Pest and termite activity – Evidence of live infestations, past timber damage, or conditions likely to attract pests (such as subfloor moisture or timber stored against the home) are noted.

- Site and surrounds – Driveways, retaining walls, fencing, and outbuildings are reviewed for stability, damage, or potential hazards.

Limitations of Inspections

Although inspections are detailed, they have clear boundaries. They do not involve invasive testing, nor do they guarantee future performance. Instead, they provide a snapshot of the property’s condition at the time of inspection. This information allows buyers to make decisions based on documented observations rather than assumptions.

Why Licensed Builder Inspections Provide More Certainty

The value of a Residential Pre-Purchase Inspection lies not only in the checklist but also in the inspector’s expertise. A licensed builder is better placed to recognise when an issue appears more cosmetic in nature and when it may suggest a more serious structural concern. At ImpeccaBuild, we draw on years of construction experience to deliver reports that explain what defects may mean in practical terms and what further investigation or remediation may be appropriate.

This approach helps ensure buyers are equipped with clear, actionable knowledge before signing a contract.

Costs of Residential Pre-Purchase Inspections in Sydney

How Much Do Residential Pre-Purchase Inspections Cost in Sydney?

The cost of a Residential Pre-Purchase Inspection in Sydney typically ranges between $400 and $800, depending on the size, type, and condition of the property. Larger or more complex homes may cost more, while small apartments are generally at the lower end of the scale.

Factors That Influence Price

- Property size – A two-bedroom apartment usually takes less time to inspect than a five-bedroom house, so costs are lower.

- Age and condition – Older homes often require more thorough checking due to wear, outdated construction methods, or previous renovations.

- Combined inspections – Choosing a building and pest inspection package is usually more cost-effective than booking them separately.

- Urgency – Pre-auction inspections or last-minute bookings may attract a premium because of the short turnaround time.

Value vs Cost

While some buyers focus on saving money upfront, skipping or choosing the cheapest inspection can be a costly mistake. For example, a $600 inspection might identify termite damage or roof leaks that could otherwise lead to $15,000–$30,000 worth of repairs after purchase. In a city like Sydney, where property prices are high and repair costs add up quickly, inspections represent a fraction of the potential financial risk.

Why Prices Vary Between Inspectors

Not all inspections are equal. Some low-cost providers deliver short, generic reports that miss critical details. Others lack the building knowledge needed to identify serious risks. At ImpeccaBuild, we pride ourselves on being licensed builders who deliver detailed, practical reports that explain not just what’s wrong, but what it means for the buyer’s budget and safety. This expertise ensures real value, even if the fee is slightly higher than the cheapest alternative.

Step-by-step Residential Pre-Purchase Inspections process

The Residential Pre-Purchase Inspection Process: Step by Step

Understanding how a Residential Pre-Purchase Inspection is carried out helps buyers know exactly what to expect and how to use the findings to their advantage.

1. Booking the Inspection

The process begins once you have found a property you’re interested in. In Sydney’s fast-moving market, it’s important to book the inspection quickly, particularly if the property is going to auction. The inspector will coordinate with the agent or vendor to arrange access.

2. Pre-Inspection Preparation

Before the inspection, buyers can raise specific concerns, such as suspected roof leaks, uneven floors, or moisture issues. This ensures the inspector pays close attention to the areas that matter most to the buyer.

3. On-Site Inspection

The inspection itself usually takes between one and three hours, depending on the property’s size and complexity. The inspector examines the exterior, roof, interior rooms, plumbing fixtures, electrical points, subfloor spaces and surrounding site features. Tools such as moisture meters or thermal cameras may be used to help identify potential issues that are not immediately obvious during a standard visual check.

4. Report Preparation

After the site visit, a written report is prepared. In most cases, buyers receive the report within 24 hours — a critical timeframe for Sydney auctions. The report includes photographs, a summary of findings, detailed descriptions of defects, and recommendations for repairs or further investigation.

5. Reviewing the Report with the Inspector

A report alone can be overwhelming, so speaking directly with the inspector provides context. A licensed builder can explain which issues are cosmetic, which are urgent, and what each defect means for repair costs and safety. This interpretation is where experience matters most.

6. Next Steps for Buyers

Once the report is reviewed, buyers can decide how to proceed. If significant problems are uncovered, they may renegotiate the purchase price, request the vendor to fix issues, or choose to walk away entirely. If no major concerns are found, buyers gain the peace of mind to proceed with confidence.

Finding Sydney’s best Residential Pre-Purchase Inspections

Choosing the Right Inspector in Sydney

The quality of a Residential Pre-Purchase Inspection depends heavily on the inspector. Not all inspectors have the same qualifications, and choosing the wrong one can leave buyers exposed to serious risks. A poorly trained inspector may overlook structural movement, termite damage, or compliance issues, which could later cost the buyer tens of thousands of dollars in repairs.

Qualifications to Look For

The most important requirement is that the inspector is a licensed builder. This ensures they understand construction practices, local building codes, and the kinds of shortcuts that are often hidden beneath cosmetic finishes. Inspectors without a building background may produce lengthy reports but miss the significance of what they are looking at. Sydney properties are diverse — from Victorian terraces to modern apartments — and each type presents unique challenges that require practical construction knowledge to identify.

The Risk of Cheap or Unqualified Inspectors

It can be tempting to choose the lowest-priced inspection, but cheaper providers often deliver generic, tick-box reports with little explanation of the defects found. Worse still, some inspectors lack the expertise to detect serious issues in the first place. The initial savings can quickly become irrelevant if the buyer inherits hidden problems such as termite damage, unsafe wiring, or failed waterproofing.

A Simple Analogy

You wouldn’t trust someone who isn’t a mechanic to repair or inspect your car — so why risk engaging an inspector who isn’t a licensed builder to assess a home worth hundreds of thousands of dollars? When the stakes are this high, expertise and experience are non-negotiable.

Why ImpeccaBuild Is the Right Choice

At ImpeccaBuild, every inspection is carried out by licensed builders with years of hands-on construction experience. We don’t just list defects — we explain what they mean, how urgent they appear to be and when it may be appropriate to obtain quotes or further specialist advice. Our clients across Sydney rely on us to provide clarity and confidence at the most important stage of the property-buying process.

ImpeccaBuild leads in Residential Pre-Purchase Inspections

Why Choose ImpeccaBuild for Your Pre-Purchase Inspection?

Not all inspection providers offer the same depth of insight. At ImpeccaBuild, we approach Residential Pre-Purchase Inspections differently — every inspection is conducted by licensed builders with real construction experience. This gives our clients a deeper level of assurance because we understand how homes are put together and where problems are most likely to appear.

The Licensed Builder Advantage

Many inspection companies rely on subcontractors or franchise operators with limited building knowledge. We believe that assessing a home worth hundreds of thousands — often millions — of dollars requires more than a checklist. Our builder-led inspections are focused on recognising shortcuts in workmanship, identifying visible safety hazards and highlighting potential structural risks that might otherwise be overlooked.

Local Experience Across Sydney

Our team has spent years building and inspecting properties across Sydney, from heritage terraces in the Inner West to modern apartments and freestanding homes in the suburbs. This local experience means we are familiar with Sydney-specific risks such as termite activity, rising damp, and waterproofing failures — problems that can quickly turn into major expenses if not identified before purchase.

Clear, Practical Reports

We don’t overwhelm clients with jargon. Instead, our reports are written in plain English, supported by photos, and structured to highlight what really matters. Each issue is explained in context — whether it is minor wear and tear, a major structural concern, or something that may need further specialist advice. This clarity helps buyers decide whether to proceed, renegotiate, or walk away.

Focused on Protecting Buyers

Our inspections are carried out with one priority: acting in our clients’ best interests. We encourage questions, explain our findings in detail and aim to ensure buyers feel well informed before making a decision. Many of our clients tell us that our guidance helped them avoid unexpected issues or gave them the confidence to proceed with their purchase.

When it comes to securing your future home in Sydney, choosing ImpeccaBuild means choosing experience, clear communication and a team that puts your interests first.

Secure your future with Residential Pre-Purchase Inspections

Conclusion – Protect Your Future with a Residential Pre-Purchase Inspection

Buying a home in Sydney is an exciting milestone, but it also carries significant financial risk. Properties that look perfect on inspection day can hide structural weaknesses, pest activity or costly repair needs that only become apparent after contracts are signed. A Residential Pre-Purchase Inspection provides buyers with greater clarity, helping to identify many of these issues before they become your responsibility.

Throughout this guide, we’ve shown how inspections can support buyers: from highlighting possible structural problems and signs of termites to giving first-home buyers more confidence and helping investors better understand how a property may affect their returns. Above all, inspections provide peace of mind — allowing you to make decisions based on clear observations rather than guesswork.

At ImpeccaBuild, we are proud to deliver inspections backed by licensed builder expertise. We know Sydney homes inside and out, and we provide clear, practical reports that explain what defects may mean and what action might be needed. Our focus is always on helping clients minimise the risk of costly surprises and secure their future with greater confidence.

Before you commit to your next property, make sure you have the right knowledge on your side. Book your Residential Pre-Purchase Inspection with ImpeccaBuild today and take the first step towards buying smarter and safer.

FAQ’s on Residential Pre-Purchase Inspections

Frequently Asked Questions

1. What is a Residential Pre-Purchase Inspection?

A Residential Pre-Purchase Inspection is a professional, non-invasive assessment of a property’s condition carried out before purchase. It helps identify defects, safety hazards and potential risks that are visible in accessible areas so buyers can make more informed decisions.

2. Why are Residential Pre-Purchase Inspections important in Sydney?

Sydney’s property market is fast-paced, and homes often sell quickly. Inspections help buyers reduce the risk of hidden problems such as termites, damp or structural issues that can cost thousands to repair after settlement.

3. What does a Residential Pre-Purchase Inspection cover?

A Residential Pre-Purchase Inspection typically covers the structure, roof, interior, and visible, accessible plumbing, electrical and drainage elements, as well as moisture issues and signs of pest activity. It also assesses the property’s surrounds, such as retaining walls and driveways.

4. How much do Residential Pre-Purchase Inspections cost in Sydney?

The cost of a Residential Pre-Purchase Inspection in Sydney usually ranges from $400 to $800. The price depends on factors such as property size, age, condition, and whether a combined building and pest inspection is included.

6. How long does a Residential Pre-Purchase Inspection take?

Most inspections take between one and three hours, depending on the size and complexity of the property. Buyers typically receive the written report within 24 hours.

7. Can I use a Residential Pre-Purchase Inspection to negotiate the property price?

Yes, inspection reports often give buyers leverage to renegotiate. If defects are found, buyers can request a price reduction, ask the vendor to complete repairs, or walk away from the purchase.

8. Who should carry out a Residential Pre-Purchase Inspection?

Inspections should be conducted by a licensed builder with hands-on construction experience. A builder has the knowledge to identify serious issues and provide practical advice that less qualified inspectors may miss.

9. Do first-home buyers need a Residential Pre-Purchase Inspection?

Yes, first-home buyers benefit greatly from inspections. They help reduce the risk that limited budgets will be stretched by unexpected repair costs and provide peace of mind when making such a significant financial commitment.

10. Are pest inspections included in a Residential Pre-Purchase Inspection?

Some inspections include pest checks, but many buyers choose a combined building and pest inspection for a more complete assessment. In Sydney, where termite activity is common, this option is highly recommended.

11. What happens after a Residential Pre-Purchase Inspection?

After receiving the report, buyers can decide whether to proceed, renegotiate or withdraw. The findings provide clarity and confidence, helping to ensure the purchase decision is based more on documented observations than on assumptions.

You Might Also like:

If you enjoyed reading this blog on Residential Pre-purchase Inspections, you may also be interested in:

- 6 Hidden Risks Of Buying Without A Pre-Purchase Inspection

- Pre-Purchase Building Inspection Cost Sydney: 6 Ways To Save

- Residential Pre-Purchase Inspections: 10 Powerful Benefits

- Local Cafe Fitout Expert Sydney: 6 Smart Reasons to Choose Local

- Choosing a Cafe Fitout Company Sydney: 5 Expert Tips for Success

- Cafe Fitout Costs Sydney 2024: Simple Tips for Maximum Savings

- Location Impact on Pharmacy Fit-Out Costs: 6 Shocking Truths

- Pharmacy Location Rules for New Pharmacies: 8 Approval Insights

- Reducing Pharmacy Fit-Out Costs: 5 Powerful Ways to Save Big

- 7 Critical Questions to Ask a Pharmacy Fit-Out Company Before Hiring