Buying a home in Sydney is one of the biggest financial commitments most people will ever make. It’s exciting, but it also comes with hidden risks—structural issues, pest infestations, plumbing faults, or poor workmanship that aren’t always visible during an open home. A pre-purchase inspection is designed to uncover these problems, yet many buyers hesitate, believing the additional cost is unnecessary.

The truth is, understanding the Pre-Purchase Building Inspection Cost is critical. Far from being a wasted expense, it’s an investment that can save buyers from financial stress, unexpected repairs, and sleepless nights. In fact, a thorough inspection carried out by licensed builders often pays for itself many times over, whether through avoided repairs or negotiating power at the point of purchase.

At ImpeccaBuild, as licensed builders who’ve built and worked on countless homes, we bring real, hands-on construction knowledge to every inspection. That background allows us to identify risks others might miss, ensuring Sydney buyers get clear, reliable insights before making such a major investment. In this blog, we’ll break down what a Pre-Purchase Building Inspection Cost typically covers, what factors influence it, and—most importantly—six powerful ways buyers can actually save money without compromising on quality.

If you’re new to the process and want to better understand the broader value of inspections, take a look at our guide to Residential Pre-Purchase Inspections: 10 Powerful Benefits.

Understanding Pre-Purchase Building Inspection Cost Basics

What Is a Pre-Purchase Building Inspection?

A pre-purchase building inspection is a detailed, visual assessment of a property’s condition carried out before a buyer commits to purchase. The aim is to help identify significant issues that could affect safety, liveability or long-term maintenance costs. In Sydney’s fast-paced property market, where homes are often bought under auction conditions or with limited cooling-off periods, having this information upfront can make it easier to decide whether to proceed, negotiate or walk away.

According to NSW Fair Trading, a standard pre-purchase inspection covers major structural elements, safety concerns and visible defects—but it should not be mistaken for a compliance certificate or a cost estimate. In practice, inspectors systematically assess reasonably accessible areas such as the structural framework, roof voids, internal and external walls, floors, windows and visible plumbing, wiring and site drainage.

Signs of rising damp, leaks or foundation movement may also be noted, as these can lead to expensive repairs. Local conditions make these inspections particularly important in Sydney: older terrace homes in the Inner West often suffer from movement and dampness; coastal suburbs face salt-air corrosion and water ingress; leafy areas such as the North Shore and Hills District can be prone to termite activity; and newly renovated “flip” properties may conceal poor workmanship behind fresh finishes.

Ultimately, a pre-purchase building inspection gives buyers clearer information to help them decide whether to proceed, negotiate or walk away. It reduces the risk of unexpected issues and supports more informed negotiations, making it a sensible step before committing to a Sydney property.

Typical Pre-Purchase Building Inspection Cost in Sydney

Average Pre-Purchase Building Inspection Cost in Sydney

For most Sydney buyers, the first question is simple: how much does a pre-purchase building inspection cost? On average, the price falls between $400 and $800, depending on the property type and scope of the inspection. Smaller units may be assessed for less, while larger homes, heritage properties, or houses with complex structures can push the price higher. Pest inspections may be offered as a separate service, but bundling building and pest inspections together often provides better value.

Several factors influence the final cost:

- Property size – A two-bedroom apartment requires less time to inspect than a large family home with multiple levels, garages, and outbuildings.

- Age and condition – Older homes, especially Sydney terraces or Federation-style houses, often require closer attention to structural movement, damp issues, or outdated wiring.

- Location – Central Sydney properties may involve additional access challenges such as limited parking, while outer suburbs can require extra travel time.

- Complexity of design – Homes with extensions, unusual construction methods, or sloping sites take longer to assess.

While some companies advertise bargain inspections for under $300, it’s important to look closer at who is carrying out the work. Many low-cost operators use inspectors without a building background or licence, which means they may lack the construction knowledge needed to identify serious defects. The risk is that critical issues—like structural weaknesses or hidden moisture damage—are missed entirely. What looks like a saving upfront can quickly turn into tens of thousands of dollars in unexpected repairs.

In contrast, inspections carried out by licensed builders provide a completely different level of reassurance. At ImpeccaBuild, our builder background means we understand how homes are constructed, where shortcuts are often taken, and how to identify problems that aren’t obvious to the untrained eye. The result is a report you can trust—one that not only details defects but gives you the confidence to negotiate or walk away if needed.

Transparency is also key. A professional inspection service should clearly outline costs upfront, without hidden add-ons for travel, urgent bookings, or basic inclusions like photos. At ImpeccaBuild, we believe the Pre-Purchase Building Inspection Cost should be both fair and reflective of the quality of service—an investment that protects buyers from costly surprises.

What Pre-Purchase Building Inspection Cost Covers

What’s Included in the Cost of a Building Inspection?

When buyers consider the Pre-Purchase Building Inspection Cost, one of the first questions is: what do I actually get for my money? A professional inspection should provide a detailed, structured assessment of the property’s condition, giving you clarity before committing to purchase.

Standard Inclusions

Most inspections focus on the reasonably accessible areas of the property. This typically includes

- Structural components – foundations, walls, ceilings, floors, and roof structures are checked for movement, cracks, or deterioration.

- Moisture and leaks – signs of rising damp, water ingress, mould, or roof leaks that can weaken the home over time.

- Safety concerns – potential fire hazards, faulty wiring, loose railings, trip risks, or plumbing faults.

- Pest-related issues – visible termite activity or timber decay, often included when combined with a pest inspection.

- Photos and notes – evidence-based reporting with annotated images that support the written findings.

Level of Detail in the Report

A useful report should go beyond ticking boxes. Buyers need clear explanations of what was found, the likely implications and whether action is urgent or more preventative. NSW Government advises engaging licensed builders, architects, or surveyors to prepare inspection reports, ensuring they meet Australian Standards and provide unbiased information (NSW Government). For example, a crack in a wall might be cosmetic—or it could signal structural instability. At ImpeccaBuild, our licensed builder expertise ensures clients understand not just what the issue is, but why it matters.

What’s Not Usually Included

There are limits to what a standard inspection covers. Invasive testing such as removing wall linings, lifting floorboards, or cutting into structures is not part of a typical service. Similarly, specialist assessments—such as asbestos testing, swimming pool compliance checks, or gas line inspections—are generally arranged separately if required. A good inspector will explain these boundaries upfront so there are no surprise costs later.

Why Inspector Background Matters

One of the biggest differences between inspection companies is the expertise of the person doing the work. Many low-cost operators rely on inspectors without a building licence or building background, which means their reports may identify surface-level issues but miss the underlying causes. Licensed builders, on the other hand, know how homes are constructed and where shortcuts are often taken. At ImpeccaBuild, our inspections combine this construction knowledge with practical on-site experience, ensuring our clients receive reports that are accurate, reliable, and genuinely useful.

Understanding these inclusions upfront not only helps buyers see the value behind the Pre-Purchase Building Inspection Cost, it also prevents misunderstandings and wasted money on incomplete assessments. Next, we’ll explore six smart ways to save on inspection costs while still securing the highest level of protection.

Smart Ways To Reduce Pre-Purchase Building Inspection Cost

6 Ways To Save On Pre-Purchase Building Inspection Cost

The cost of a pre-purchase inspection can feel like just another expense during the buying process, but there are smart ways to get more value without cutting corners. Here are six strategies Sydney buyers can use to save money while still securing a high-quality inspection.

1. Compare Inspection Packages Wisely

Not all inspection services are the same. Some companies advertise low fees but provide only a basic checklist, leaving you with little more than a vague overview. Others deliver detailed reports with photos, clear explanations, and prioritised recommendations. While the second option may cost more upfront, it often saves money long term by helping you avoid serious repair bills. When comparing providers, look beyond the price tag and consider the level of detail and the inspector’s background. An inspection from a licensed builder, like the ones we carry out at ImpeccaBuild, provides far greater value than a cheap report that overlooks critical defects.

2. Bundle Building and Pest Inspections Together

Building and pest issues often go hand in hand. Booking these inspections separately not only costs more but also delays the process. Bundling them together is usually cheaper and ensures a more efficient, coordinated assessment of the property. For example, if termites are found, the structural elements of the home can be examined in detail at the same time, preventing the need for repeat visits. At ImpeccaBuild, we offer combined building and pest inspections, saving Sydney buyers both time and money while providing a complete picture of the property’s condition.

3. Use the Report for Negotiation Power

One of the most overlooked ways to save is by using your inspection report as leverage in negotiations. A report that highlights defects—whether it’s structural cracks, moisture damage, or outdated electrical wiring—can give you grounds to request repairs or negotiate a lower purchase price. It’s not uncommon for a $500 inspection to result in thousands of dollars in savings at the negotiation table. This is where inspector credibility matters.

A report prepared by a licensed builder carries more weight, because agents and vendors know the findings are backed by genuine construction expertise. At ImpeccaBuild, our clients frequently use our reports to secure better deals, making the inspection cost one of the best returns on investment in the entire buying process.

4. Book Early to Avoid Urgent Fees

In Sydney’s competitive property market, last-minute inspections are common, especially before auctions or cooling-off deadlines. Many companies charge extra for urgent bookings, pushing the price well above the average range. By arranging your inspection as early as possible, you not only avoid these rush fees but also give yourself more time to review the findings and make informed decisions. Planning ahead is a simple way to keep the Pre-Purchase Building Inspection Cost within budget while reducing stress.

5. Choose Licensed Builders Over Franchise Inspectors

The biggest cost-saving strategy is choosing the right inspector. Many inspection companies send out franchise operators or subcontractors who do not hold a builder’s licence and lack real construction experience. These inspectors may flag surface-level problems but often miss the underlying issues that can cost buyers dearly after settlement.

At ImpeccaBuild, our inspections are carried out by licensed builders who understand construction from the ground up. That expertise means we don’t just list observed defects—we explain what they may indicate, their likely implications and when further investigation or repairs may be appropriate. By helping to identify significant issues earlier, we give buyers the opportunity to consider potential costs before they commit, which can better protect both their budget and their investment

6. Understand What’s Included Upfront

A common mistake buyers make is assuming all inspections include the same scope of work. Some providers advertise low initial costs but then add charges for essentials like photos, pest checks, or follow-up explanations. Others exclude areas such as roof spaces or subfloors unless requested, leaving buyers with an incomplete picture. The best way to save money is to ensure you know exactly what is included in the fee before booking. At ImpeccaBuild, we provide transparent, upfront pricing with no hidden extras—so buyers know the report they receive will be comprehensive, accurate, and ready to rely on when making one of life’s biggest financial decisions.

Avoiding Surprise Pre-Purchase Building Inspection Cost

Hidden Costs To Watch Out For

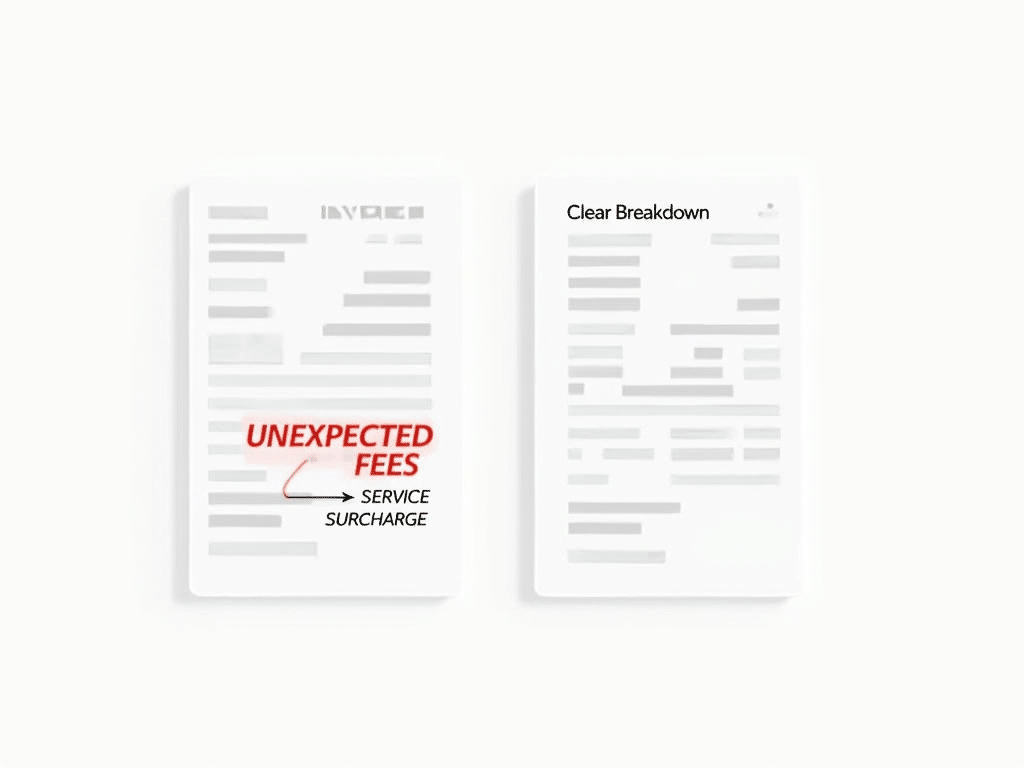

Not every inspection company is upfront about pricing. While the advertised fee may seem low, additional charges often appear along the way. Knowing what to watch for helps buyers avoid paying more than expected.

Extra Travel Fees

Some companies add travel surcharges for properties outside central Sydney, which can quickly increase the final bill. This is particularly common for homes in the Hills District, Northern Beaches, or Western Sydney. These costs should always be disclosed before booking. At ImpeccaBuild, our pricing is transparent, so clients know exactly what the inspection will cost, no matter where the property is located.

Urgent or Weekend Booking Surcharges

In Sydney’s fast-paced market, buyers often need inspections on short notice. Many operators take advantage of this by charging inflated fees for urgent or weekend bookings. Planning ahead can help avoid these surcharges, but more importantly, a professional company should offer fair rates without exploiting tight timelines.

Add-Ons for Basic Inclusions

One of the most frustrating hidden costs is when providers charge extra for what should be standard. This can include adding fees for photographic evidence, pest checks, or even providing clear explanations in the report. These are not “extras”—they are essential parts of a professional inspection. At ImpeccaBuild, detailed reports with photos and practical recommendations are included in the upfront cost, ensuring clients receive the full picture without surprise add-ons.

Re-Inspections or Follow-Up Charges

Another hidden cost comes in the form of re-inspections. Some companies charge close to the full inspection fee again if buyers want clarification or a follow-up check. This often happens when the original report lacks detail, forcing clients to pay twice for the same outcome. Licensed builders, however, are trained to identify root causes the first time around, reducing the likelihood of repeat costs. Our inspections at ImpeccaBuild are designed to provide clear, detailed findings, giving buyers confidence in the information they receive without the need for unnecessary repeat visits.

How ImpeccaBuild Handles Costs

At ImpeccaBuild, we believe transparency is non-negotiable. Our clients receive clear, upfront pricing with no hidden extras. Every inspection includes a comprehensive report with photos, actionable insights, and licensed builder expertise—without unexpected surcharges. By eliminating hidden costs, we ensure the Pre-Purchase Building Inspection Cost reflects real value, protecting Sydney buyers from financial surprises.

Why Pre-Purchase Building Inspection Cost Is Worth It

Is a Pre-Purchase Building Inspection Worth the Cost?

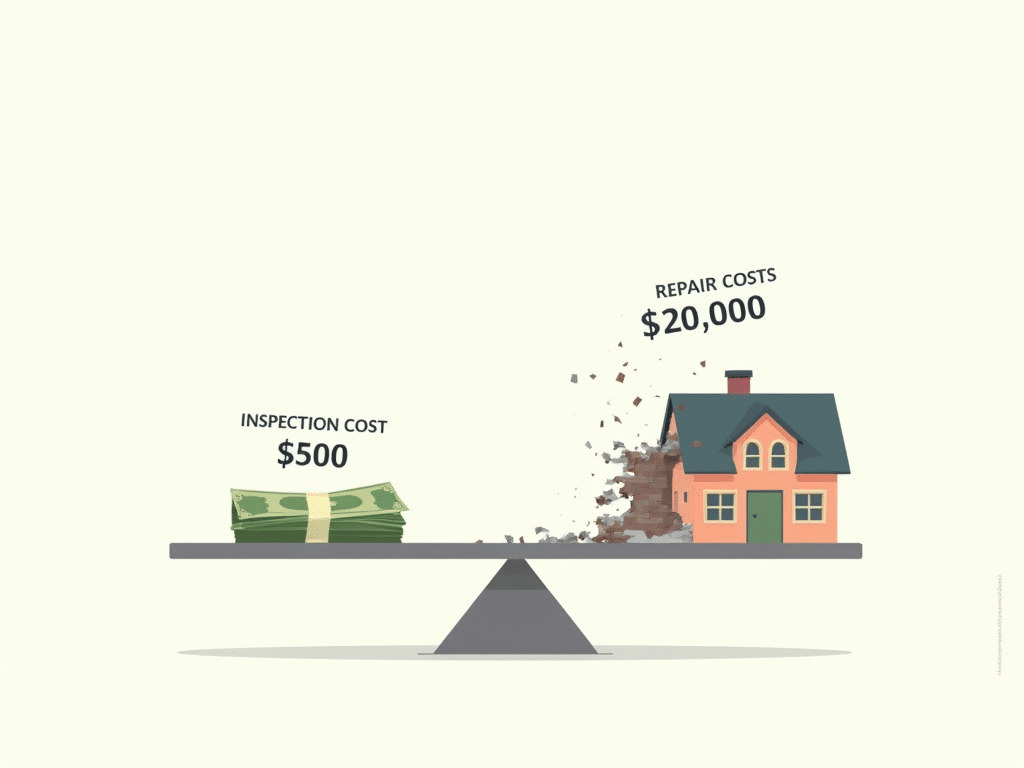

For many Sydney buyers, the Pre-Purchase Building Inspection Cost feels like just another item on a growing list of expenses. But when you weigh it against the potential risks of buying blind, the value becomes clearer. Spending a few hundred dollars today can help you avoid or better prepare for issues that might otherwise lead to significant repair costs.

Consider the cost of rectifying termite damage, replacing a leaking roof, or repairing failed waterproofing in a bathroom. These are common issues in Sydney homes, and in some cases, repairs can exceed $20,000. A standard inspection, usually costing between $500 and $800, can help identify such problems where they are visible in accessible areas before contracts are signed. In some cases, buyers have used our reports to negotiate reductions in purchase price or request repairs, which can offset the cost of the inspection.

The credibility of the report also matters. A checklist-style inspection from an operator without a building licence may flag obvious defects but fail to explain their cause or seriousness. In contrast, an inspection carried out by licensed builders provides more practical insight. At ImpeccaBuild, we don’t just report that a wall is cracked—we comment on whether it appears more consistent with minor plaster movement or may warrant further structural assessment. That level of context can give buyers greater confidence and leverage when discussing the property.

Ultimately, a pre-purchase building inspection isn’t a cost—it’s an investment. ADF Consumer highlights that while inspections aren’t legally mandatory in Australia, they are strongly recommended under the “buyer beware” principle, protecting buyers from hidden problems that could cost thousands (ADF Consumer). In Sydney’s competitive property market, skipping an inspection is one of the costliest risks a buyer can take.

Trusted Experts in Pre-Purchase Building Inspection Cost

Why Choose ImpeccaBuild For Your Pre-Purchase Building Inspection?

Not all inspection companies are the same. Many in Sydney use subcontractors or franchise inspectors who do not hold a builder’s licence, leaving buyers with reports that miss key details.

At ImpeccaBuild, every inspection is carried out by licensed builders with real construction experience. We know how homes are built and where defects are often concealed, which means we can tell the difference between cosmetic cracks and serious structural problems.

Our pricing is upfront with no hidden extras, and our reports are detailed, easy to understand, and backed by practical recommendations you can act on.

A pre-purchase building inspection with ImpeccaBuild isn’t just another expense—it’s expert, builder-level insight into one of your biggest investments, trusted by Sydney buyers who want greater clarity and confidence before they commit.

Pre-Purchase Building Inspection Cost That Pays Off

Conclusion

The Pre-Purchase Building Inspection Cost is small compared to the risks of buying blind. For a few hundred dollars, you gain greater peace of mind, negotiation power and a clearer understanding of any issues that could lead to significant repair costs.

At ImpeccaBuild, we carry out inspections as licensed builders, giving Sydney buyers insights they can genuinely rely on. Our reports are detailed, transparent and designed to help you make confident property decisions.

If you’re preparing to buy, don’t leave your investment entirely to chance. Book your pre-purchase building inspection with ImpeccaBuild today and approach your future home with informed, trusted expertise.

FAQ

Frequently Asked Questions

1. What is a pre-purchase building inspection?

A pre-purchase building inspection is a detailed, visual assessment of a property’s condition, carried out before you buy. It helps identify structural concerns, safety hazards, moisture problems and visible signs of pests in accessible areas so you can make a more informed decision.

2. How much does a pre-purchase building inspection cost in Sydney?

In Sydney, a pre-purchase building inspection typically costs between $400 and $800. Prices vary depending on property size, age, location, and whether you combine it with a pest inspection.

3. Is a pre-purchase building inspection worth the cost?

Yes. Spending $500–$800 on a pre-purchase building inspection can help buyers avoid unexpected repair costs by identifying issues before purchase. It can also support negotiations and provide greater peace of mind when buying.

4. What is included in the cost of a building inspection?

A standard building inspection includes visual checks of the structure, roof, walls and floors, as well as accessible, visible plumbing, wiring and drainage, plus signs of damp, leaks or pests. Reports also include photos and practical recommendations.

5. What’s not included in a standard pre-purchase inspection?

Most inspections don’t include invasive testing, such as removing wall linings or floorboards. Specialist checks—like asbestos, pool compliance, or gas lines—are also excluded unless requested separately.

6. How can I save money on pre-purchase building inspection costs?

You can save money by comparing inspection packages, bundling building and pest inspections, booking early, using reports for negotiations, and choosing licensed builders for accuracy and value.

7. Why should I choose a licensed builder for my inspection?

Licensed builders have real construction knowledge, allowing them to identify issues that unlicensed inspectors may overlook. Their reports are more accurate, reliable, and trusted in negotiations.

8. Are there hidden costs with building inspections?

Some providers charge hidden fees for travel, urgent bookings, or even photos in reports. At ImpeccaBuild, our pricing is upfront and transparent, with no hidden extras.

9. Can a building inspection help me negotiate the property price?

Yes. Buyers often use inspection findings to negotiate repairs or reduce the purchase price. A report from a licensed builder carries more weight and can deliver significant savings.

You Might Also like:

If you enjoyed reading this blog, you may also be interested in:

- 6 Hidden Risks Of Buying Without A Pre-Purchase Inspection

- Pre-Purchase Building Inspection Cost Sydney: 6 Ways To Save

- Residential Pre-Purchase Inspections: 10 Powerful Benefits

- Local Cafe Fitout Expert Sydney: 6 Smart Reasons to Choose Local

- Choosing a Cafe Fitout Company Sydney: 5 Expert Tips for Success

- Cafe Fitout Costs Sydney 2024: Simple Tips for Maximum Savings

- Location Impact on Pharmacy Fit-Out Costs: 6 Shocking Truths

- Pharmacy Location Rules for New Pharmacies: 8 Approval Insights

- Reducing Pharmacy Fit-Out Costs: 5 Powerful Ways to Save Big

- 7 Critical Questions to Ask a Pharmacy Fit-Out Company Before Hiring